Annually, CGI leaders around the world meet face-to-face with business and IT executives to gather their perspectives on the trends affecting their enterprises, including business and IT priorities, IT spending, budgets and investment plans. In 2020, we conducted in-person interviews with 29 oil and gas client executives across upstream, midstream, downstream and retail businesses who indicate a focus on responding to revenue pressures from low oil prices, followed by becoming digital organisations. Interviews were conducted before and after the pandemic declaration by the World Health Organization (WHO) on March 11, 2020, providing unique insights into evolving priorities. We provide a short summary of some of these insights here.

Responding to revenue pressures is the highest-impact trend

| This year, responding to revenue pressures resulting from low oil prices has risen to become the most impactful trend, ahead of becoming a digital enterprise. Increasing amounts of data insights and analytics to harness business value is now the third most impactful trend. Cybersecurity and changing operational and business models to drive operational excellence continue as the fourth and fifth most impactful trends, respectively. |

2020 top trends by impact

|

Post-pandemic declaration trends show a rise in the importance of operational efficiency and excellence as an IT priority

For interviews conducted after the pandemic declaration by the WHO on March 11, 2020, operational efficiency and excellence rises in importance as an IT priority (+33%) while embracing new IT delivery models such as cloud and agile lessens (-53%). Post pandemic, the importance of cost reduction and performance improvement as a business priority rises (+19%).

Results from digital strategies are still low

This year, 97% of oil and gas executives report their organisations have some form of a digital strategy in place. However, only 11% are producing results from those strategies, down from 15% in 2019. Additionally, 69% indicate they have an enterprise-wide strategy, but just 17% report their enterprise strategy extends to their external ecosystem.

Few executives cite having highly agile business models for digitisation

Only 10% of executives indicate their business model is highly agile (score of 8 or higher on a scale of 1 to 10 with 10 highest) when it comes to addressing digitisation, down 8 points from 2019.

Interest in substantial IT managed services rises slightly

This year we asked oil and gas executives to share why they use managed services and how they plan to leverage them. The top reasons are to save costs and to maintain control.

% currently leveraging substantial managed applications 56% 2020 51% 2019

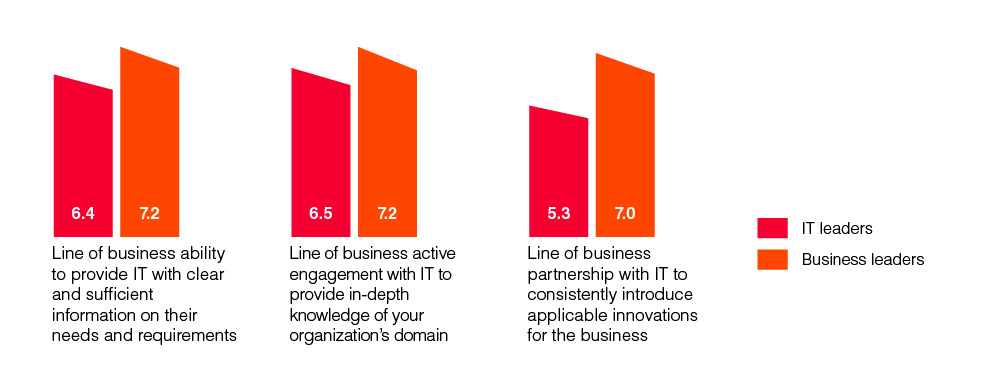

Benchmarking clients’ satisfaction with their own IT organisation

(Scores from 1 to 10, with 10 most satisfied, showing 3 out of 10 available attributes)

For the third year, business and IT executives interviewed ranked their satisfaction with their own IT organisations based on the 10 key attributes of a world-class IT organisation. For most attributes, business leaders report the same or higher satisfaction levels with their internal IT compared to IT leaders. Line of business partnership with IT to consistently introduce applicable innovations for the business shows the largest satisfaction gap (1.7 points), with IT executives scoring themselves 18% lower than last year.

Learn more about the 2020 CGI Client Global Insights.

Learn more about CGI in Oil and Gas.

Speak with a CGI expert

To consult with one of our industry experts to learn more about client insights and CGI’s perspectives on business and technology trends, contact us.